Step 1- Problem or Opportunity Statement

I saw bank offered gadget as gift that can be chosen by their customer depends on how long they agree to hold their money in the bank.

Based on their program, I think Samsung Galaxy S III Mini will be my target! If I want to get S III mini, I have to put IDR 35.000.000 for 24 months of holding period. I’ve already checked the price of Samsung SIII mini, which is IDR 2.800.000.

I want to analyze, is that program really give me a benefit? Continue reading

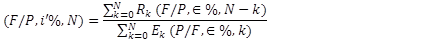

(1-1)

(1-1) (1-2)

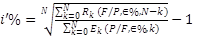

(1-2)

(1-3)

(1-3)